How you manage your finances should be one of the most important things you do. In most circumstances, failing to have a budget is the top mistake people make with their finances. If you don’t have any form of budget then you likely have absolutely no idea what shape your finances are in.

The good news is that there is no set method for budgeting. Everyone has different financial situations and priorities. There is no such thing as a one size fits all approach, so you can comfortably find the best system for you, and as long as it is realistic for your situation, then all the better.

When assessing people’s finances however, I see some common themes. Having a budget is one thing, but if you are making some other mistakes along the way, all the budgeting in the world is not going to get you where you need to go.

Here are the top 5 mistakes people make with their finances:

1. You are paying your bills late

As of March 2014, the credit rating system was changed to incorporate late bill payments. Previously if you paid a utility bill a few days late, it was no biggie, but now it could have a negative impact on your credit score. Couple that with the fact that if you pay a bill late, you usually incur late fees. If you pay your bills on time, you’ll be able to pay the lower amount and won’t have to worry about your credit rating next time you try and get a loan.

2. You underestimate your yearly expenses

When it comes to budgets, you need to include everything in there. Most people underestimate what they actually need to pay for during the year. Don’t just put aside money for ‘bills’. Work out each of your bills for the year, and make sure the money you set aside is enough to cover them all. If you don’t set aside the right amount of money, you will end up blowing your budget at some point down the track anyway, so be realistic when establishing your budget.

3. You don’t give yourself spending money

It is important, when managing your finances to give yourself some ‘play’ money. Too often I see people creating very strict budgets for themselves, and falling off the bandwagon 2 weeks in. Incorporating a set amount of spending money each week will keep your sanity in check. You can allocate an amount of money to go towards the fun stuff, like dinners, coffees, the movies etc. You don’t have to feel guilty about it, because if your budget is set up correctly, the rest of your expenses should be covered.

4. You live off your credit card

Credit cards can be a great transactional tool, if you can be trusted with them. If however you have a problem with spending too much each month, then you should consider getting rid of the credit card and getting yourself a debit card instead. This will ensure that you can’t overspend each month and will help to keep you on track.

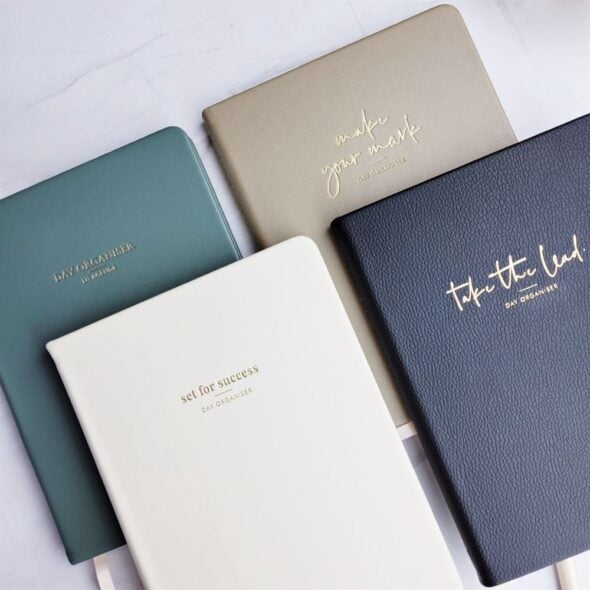

Get more out of every day, at work and at play, with our range of Day Organisers that will up your game. Its unique layout will clarify your priorities, stimulate productivity and give you a daily dose of motivation.

5. You don’t have any emergency cash

Budgeting your yearly expenses is one thing, but you never know what life is going to throw at you that could completely blow the budget. In the last year alone, I have had to pay an excess on insurance for the crazy storms in Brisbane, and my George Foreman grill broke and needed replacing. How could you anticipate or plan for these expenses? You can’t, but you can set aside some emergency money specifically for these type of things. In our household we keep $2,000 aside to pay for these unexpected nasties, but depending on your personal situation, this amount could be different.

Budgeting and money management is more than just writing down your expenses on the back of an envelope. With the above tips, you will be able to take your budget from ok, to actually working for you over the long term.

Image via Pixabay under Creative Commons CC0

Cara Brett is the Director and Senior Financial Adviser at Bounce Financial. Having worked in the financial services industry since 2003, she saw an opportunity to work with the young professionals and the movers and shakers in Brisbane, and so Bounce was born.