When it comes to superannuation, everyone should be aware of the basics behind it – how it works, how to grow it and why it’s important. But for many, superannuation is a confusing conundrum, and if you’re young and starting out in the workforce, it isn’t even a consideration.

But if you’re a female, understanding superannuation and how it affects you should be a priority. An April 2014 article in The Age states that “women in their 50s and over have roughly half the super balances of men the same age”. When women are more often than not the primary caregivers in their families, and therefore the ones who work part time or stay home full time, their ability to earn consistent money to top up superannuation is depleted.

So what can women do to ensure their superannuation is secure, regardless of life and career stage?

The hard truth about women and super

Aside from the fact that women will spend more time than their male counterparts in either part-time work or without an income due to at-home family responsibilities, the reality is that women live longer than men too, and it’s therefore even more important that women accrue enough in their super to retire. You will also need to take into account that single parents are often women, and therefore the ability to generate money for retirement is harder for a single mother.

But there are ways for women to take care of their superannuation!

“If you’re a female, understanding superannuation and how it affects you should be a priority”

Explain Superannuation to me!

Superannuation is vital because it’s your retirement money. This money is gathered throughout your working life and comes from assistance in the form of contributions from your employer, and at any point can be topped up by you, too. Co-contributions from the government can also make up your superannuation account.

There are many superannuation funds you can chose from and it’s important you read the documentation and make decisions based on what’s right for you. CareSuper, for example, is run only to profit members and not shareholder or financial planners, so that means more of YOUR money goes back to YOU.

Understanding your Super fund

Whether you’re finally getting off the company-set super fund you were automatically given, or simply re-evaluating your super fund options, it’s important to understand what your super fund can do for you, and what areas of your fund you should focus on. When comparing super funds, remember to:

- Look out for low account keeping fees

- Choose a super fund that has done well in the past 5-6 years or so,and not just last year’s Money Magazine’s top winner

- Analyse the fund’s investment options and see if they suit you

- Check that you have insurance (life, disability etc.) if you – or your family – want to be covered in the event of a loss of income

“Women more often than not … work part time or stay home full time … their ability to earn consistent money to top up superannuation is depleted”

Building your super – Spouse Contributions

You or your spouse can help the other via Spouse Contributions, a system wherein your spouse/partner makes contributions to your account regardless of your income. The spouse making the contribution can put in up to $3000 into your account each year, and if they’re helping someone that is a low-income earner, they may receive a rebate.

CareSuper offers this facility and is particularly valuable for women who work part-time or stay home full time.

Building your super – Co-contribution

This scheme allows those earning up to $49,488 to be eligible for a tax-free contribution to your superannuation from the federal government, provided you also make an after-tax contribution to your super account. You might receive up to $500 in one financial year as a co-contribution amount from the federal government, however this depends on the amount you also contributed.

“Lost super … is just poor money management, particularly as each account attracts account keeping fees that are probably eating away at the paltry amount of money it holds”

Building your super – Consolidate!

Lost super floating around in the ether in a number of different super accounts is just poor money management, particularly as each account attracts account keeping fees that are probably eating away at the paltry amount of money it holds. If you’re one of those women who have switched jobs often, then consolidating your super is a great way to boost your retirement fund. Track down your lost super via sites like www.findmysuper.com.au or the ATO’s SuperSeeker page.

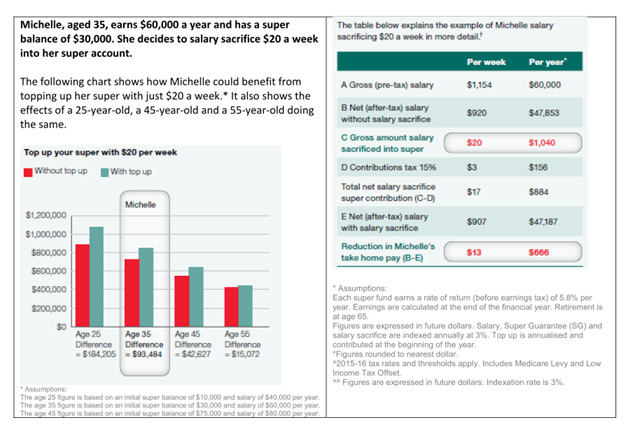

Building your super – Salary sacrificing

Grow your super – ask your employers about salary sacrificing. This is when you agree with your employer, on top of the 9.5% they must contribute to your super fund, to also pay part of your before-tax pay into your super fund.

Educate yourself

If you’re still unsure about the best ways for you to top up your super, choose a fund that’s right for you or if you have any other general enquiries, it’s important that you get that information cleared up for you.

Featured photo credit: jDevaun via photopin cc

This post is in collaboration with, and has been sponsored by, CareSuper. Terms and Conditions apply to any product you consider. This post contains factual info and my own opinion about super in general. It doesn’t take into account your situation. While Leaders in Heels does not personally recommend CareSuper, information about superannuation can be obtained from their website caresuper.com.au and it’s always good to get your own advice about financial matters.